Simplify and streamline your payroll and time attendance management with DoEmploy. This user-friendly app is designed for small businesses and household employers, freeing you to focus on growth while ensuring accurate payroll and seamless attendance tracking. DoEmploy offers automated payroll management, federal and state tax calculations, W-2 form generation, customizable payroll settings, and intuitive time and attendance tracking. Experience the convenience and efficiency of automated payroll, seamless attendance tracking, and compliant reporting – all at your fingertips. Click here to download now.

Features:

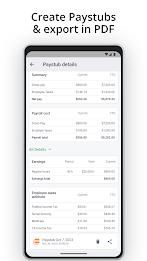

- Simplified Payroll Management: Automate payroll, calculate salaries, deductions, and taxes; generate comprehensive reports and paystubs easily.

- Federal & State Taxes: Automatically calculate federal income and FICA taxes; supports specific states for accurate tax calculations.

- W-2 Form Generation: Generate and pre-fill W-2 forms, export as PDFs, and easily modify fields.

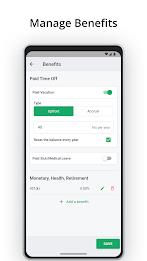

- Benefits Management: Manage PTO and calculate withholdings/contributions for benefits like cafeteria plans, retirement plans, and savings accounts.

- Customizable Payroll Settings: Tailor settings to your business needs, defining pay periods, overtime rules, and tax calculations. DoEmploy Payroll

Conclusion:

DoEmploy simplifies payroll and time attendance management for small businesses and household employers. Its automated calculations, seamless tracking, and customizable settings offer convenience and efficiency. Features like simplified payroll management, tax calculations, W-2 generation, benefits management, and customizable settings streamline processes and ensure compliance. Experience the efficiency of DoEmploy and optimize your business operations.