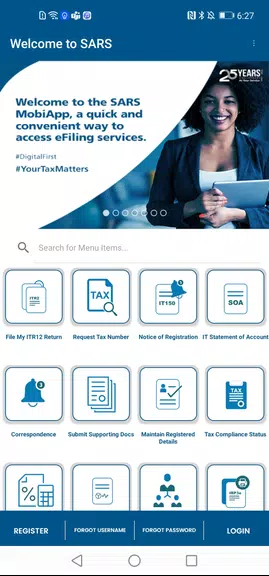

Key Benefits of SARS Mobile eFiling:

- Mobile Accessibility: File tax returns conveniently from smartphones or tablets without being tied to a desktop computer

- Flexible Workflow: Save and edit returns offline before final submission when internet connectivity improves

- Financial Planning: Built-in tax calculator provides immediate estimates to help with financial decision-making

- Data Protection: Bank-grade security measures safeguard all sensitive taxpayer information

Common Questions:

How secure is mobile tax filing?

All data transmissions use advanced encryption, meeting the same security standards as online banking platforms.Can I review previous tax submissions?

Yes, the app provides access to your assessment history including Notices of Assessment (ITA34) and Statements of Account (ITSA).Available for business taxes?

Currently the mobile platform only supports individual taxpayers filing personal income tax returns.

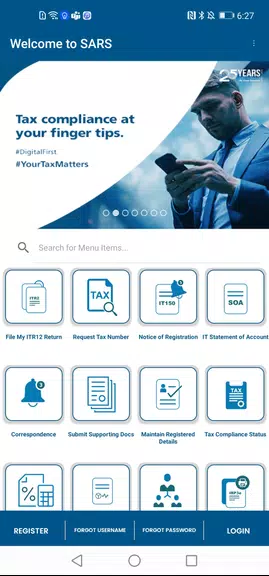

Why It Matters:

By combining portability with robust functionality, the SARS Mobile eFiling app transforms tax compliance into a seamless mobile experience. Whether you're traveling, working remotely, or simply prefer smartphone convenience, this tool puts complete tax management in your pocket. Experience the freedom of mobile tax filing - download now and simplify your annual tax obligations.