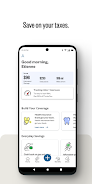

Effortlessly manage business expenses and mileage with Stride, the completely free app designed for independent workers and business owners. Save thousands on your taxes by accurately tracking mileage and expenses. Stride's automated mileage tracking simplifies the process, automatically capturing business miles and expenses for easy tax filing. Key features include streamlined expense logging (car washes, phone bills, etc.), automated GPS mileage tracking, helpful reminders to ensure you don't miss any deductible miles, and convenient IRS-ready tax reports. Unlock significant tax savings with integrated bank connections and insightful in-app guidance. Ideal for rideshare drivers, delivery drivers, freelancers, and various other professionals. Download Stride today and start maximizing your tax deductions.

Six Key Features:

- Automated Mileage Tracking: Precisely track business miles and optimize mileage deductions for substantial tax savings.

- Comprehensive Expense Tracking: Log all relevant expenses, from car washes to phone bills, identifying potential write-offs.

- GPS-Powered Mileage Tracking: Leverage GPS technology for accurate and efficient mileage tracking.

- Smart Reminder System: Receive timely reminders to ensure consistent mileage logging.

- IRS-Compliant Reports: Generate IRS-ready tax reports for straightforward tax filing.

- Broad Professional Applicability: Suitable for a wide range of professionals, including rideshare drivers, delivery drivers, and independent contractors.

Conclusion:

Stride is a free, intuitive app empowering independent workers to effortlessly track business mileage and expenses, resulting in significant tax savings. Its automated features, detailed expense logging, and IRS-ready reports streamline the tax preparation process, maximizing deductions. A must-have for any professional seeking efficient expense and mileage tracking.